The first time you get an extra bill from your mortgage company because of a shortfall, you might feel confused.

You’ve been paying your monthly mortgage on time, every time. So why in the world is the bank charging you more?

The answer – ESCROW. Escrow is a word most people don’t use in their daily life, and we’re here to help you understand. To really get it though, you have to understand all 3 parts of your monthly mortgage payment so here’s how it works:

When you make your monthly mortgage payment, you’re actually paying your mortgage company for 3 different things:

1. Principle:

The part of your monthly payment that goes toward paying down your debt.

2. Interest

The part of your monthly payment that goes to the mortgage company for the ability to borrow their money

3. Escrow Account Contribution

The part of your monthly payment that goes toward paying your property taxes & homeowners Insurance.

If you have a Fixed Rate Mortgage, then the only time your monthly mortgage payment should change is if your property taxes or your homeowners insurance increase.

No Title

No Description

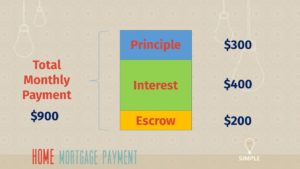

Here’s an image that shows a typical breakdown of your monthly mortgage payment. In this example, you’re paying $900 all together. $300 is going to Principle, $400 to Interest, and $200 to your Escrow Account.

Let’s focus for a moment on how principle and interest work, and how the amount that goes toward each changes over time.

When you start paying your mortgage, a greater percentage of the payment will go to interest than to principle. Over time, the total amount owed goes down, and the interest will go down with it. As the interest goes down, your payment remains the same. This means more of your payment goes toward principle, which helps pay the loan down even more quickly.

IMPORTANT – there are 2 kinds of interest rates:

- Fixed Rate – you know what your interest rate is going to be for the duration of your loan

- Adjustable Rate – your interest rate may be fixed for a short duration (like a year, 5 years, or 10 years) and then it can be adjusted for the rest of the loan. This is not favorable for the borrower, and therefore we recommend Fixed Rate loans rather than Adjustable Rate loans.

Now we can address your ESCROW ACCOUNT CONTRIBUTION.

An Escrow Account can be thought of as a little bank account that exists for the sole purpose of accumulating funds to pay your property taxes and homeowners insurance. The reason the mortgage company wants control over this pot of money is to ensure your property taxes and homeowners insurance are paid (and paid on time). Failure to pay property taxes will result in a lien on your home, which could prevent you or the bank from selling it. If you don’t pay for your homeowners insurance and a tragedy destroys your home, you’ll still owe the bank but you won’t have insurance to cover the loss, which is likely to lead to your bankruptcy and the bank never getting paid back.

Here’s how your escrow account works…

In this example, you’ve paid $200/month into your escrow account for the past 6 months.

By month 6, your escrow account holds $1200. Then, the homeowners insurance company sends a bill to the mortgage company. The homeowners insurance costs $1000 for the next year, so the escrow account pays in full, leaving $200 in the escrow account.

All good, right?

However, things can get tricky if there’s not enough money in the account to cover the bill. Sometimes your insurance or property tax costs change. If you haven’t paid enough into the account when the bill comes due, then your escrow account will be overdrawn.

In the first example, the insurance bill was $1000 but what if it went up to $1700. Your account only has $1200 available, so the mortgage company is going to pay the insurance bill, and your account will be negative $500.

The mortgage company will then increase the escrow portion of your mortgage payment to ensure that this doesn’t happen again. The result is your mortgage payment goes up by an extra $100 every month.

Now, if it was a confusing bill that made you grab your computer to do a little research on this topic, pull it out and read it again. Does it make more sense?

We hope so!

If not – give your mortgage company a call, and a friendly person will walk you through what you owe, why, and how you can pay it.

We want you to shine, so we’ve made a bunch of free, super helpful resources, just for YOU:

Guide to Home and Auto Insurance

Facebook – Twitter – YOUTUBE

Need an Independent Insurance Agent? contact us right here